|

|

Systematic Investment Plan

Systematic Investment Plan or SIP is a disciplined way of investing one's money

in order to take advantage of the volatility in the market, and thus drawing maximum

benefit out of our investments over a longer period of time. The plan aims at a

better future for its investors.

How it Works?

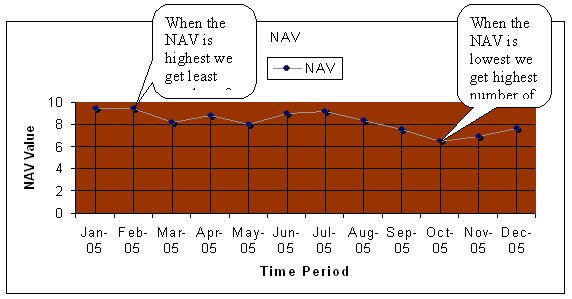

I t works on the principle of Rupee Cost Averaging (‘RCA’) by which one puts in a

certain sum of money every month in a mutual fund regularly, the prevailing NAV

of the fund determines the number of units that will be allocated to you. Thus,

it reduces the market timing problem. To illustrate this lets compare investing

the identical amounts through a SIP and in one lump sum.

Concept of Rupee Cost Averaging

|

Imagine Karan invests Rs.1000 every month in an equity

mutual fund scheme, starting in January. His friend, Arjun, invests Rs. 12000 in

one lump sum in the same scheme. The following tables illustrate how their

respective investments would have performed from Jan to Dec:

|

|

|

|

Tarun's Investment

|

|

Kumar's Investment |

|

Month

|

NAV

|

Amount

|

Units

|

Amount

|

Units

|

|

Jan-01

|

9.345

|

1000

|

107.0091

|

12000

|

1284.1091

|

|

Feb-01

|

9.399

|

1000

|

106.3943

|

|

|

|

Mar-01

|

8.123

|

1000

|

123.1072

|

|

|

|

Apr-01

|

8.750

|

1000

|

114.2857

|

|

|

|

May-01

|

8.012

|

1000

|

124.8128

|

|

|

|

Jun-01

|

8.925

|

1000

|

112.0448

|

|

|

|

Jul-01

|

9.102

|

1000

|

109.8660

|

|

|

|

Aug-01

|

8.310

|

1000

|

120.3369

|

|

|

|

Sep-01

|

7.568

|

1000

|

132.1353

|

|

|

|

Oct-01

|

6.462

|

1000

|

154.7509

|

|

|

|

Nov-01

|

6.931

|

1000

|

144.2793

|

|

|

|

Dec-01

|

7.600

|

1000

|

131.5789

|

|

|

|

Total

|

|

12000

|

1480.6012

|

12000

|

1284.1091

|

|

|

|

|

As seen in the table, by investing with a SIP, Karan ends up buying more units

when the price is low and fewer units when the price is high. However, over a

period of time these market fluctuations are generally averaged. And hence the

average cost of the investment is often reduced. |

|

|

At the end of the 12 months, Karan has more units than Arjun, even though they

invested the same amount. That's because the average cost of Karan's units is

much lower than that of Arjun. Arjun made only one investment and that too when

the per-unit price was high. Karan's average unit price = 12000/1480.6012 = Rs.

8.105 Arjun's average unit price = Rs. 9.345.

|

|

How to start an SIP?

|

When you get your salary cheque, you promise yourself you will start saving by

putting aside a little sum every month. But, all you do is make the same promise

month after month, and you just end up making the promise every month, but no

saving really happens. |

Assuming that you have an appetite for a little risk, the best way to keep the

promise is to start a systematic investment plan with a mutual fund scheme

|

- Pick any date of a month, and then fill out an SIP form and

an application form.

- Draw post-dated monthly adding up to at least minimum investment of scheme or

you can choose ECS Scheme.

- Monthly - Start with any dates of any month, and stick to the same date of every

month.

|

|

If in any month the chosen date is not a Working Day, the transaction will be

completed on the next Working Day.

|

|

|